In today’s complex financial landscape, understanding financial statements is essential for making informed decisions, whether you’re an investor, a business owner, or a financial professional. Financial statement analysis is a powerful tool that provides insights into a company’s performance, stability, and growth potential. In this comprehensive guide, we will demystify the world of financial statement analysis, breaking down complex concepts into easy-to-understand language for our U.S. audience.

What Are Financial Statements?

Financial statements are vital documents that provide a summary of a company’s financial performance and position over a specific period, usually a year or a quarter. These statements are the primary tools for assessing a company’s health, and they help stakeholders understand how a company generates revenue, incurs expenses, and manages its resources.

Financial statements are typically prepared following accounting principles and standards to ensure consistency and accuracy. Understanding these documents can be an invaluable skill for investors, creditors, managers, and anyone involved in financial decision-making.

Financial statement analysis is a crucial process for evaluating the financial health and performance of a company. By examining a company’s financial statements, including the income statement, balance sheet, and cash flow statement, analysts can gain valuable insights into its profitability, solvency, and overall financial stability.

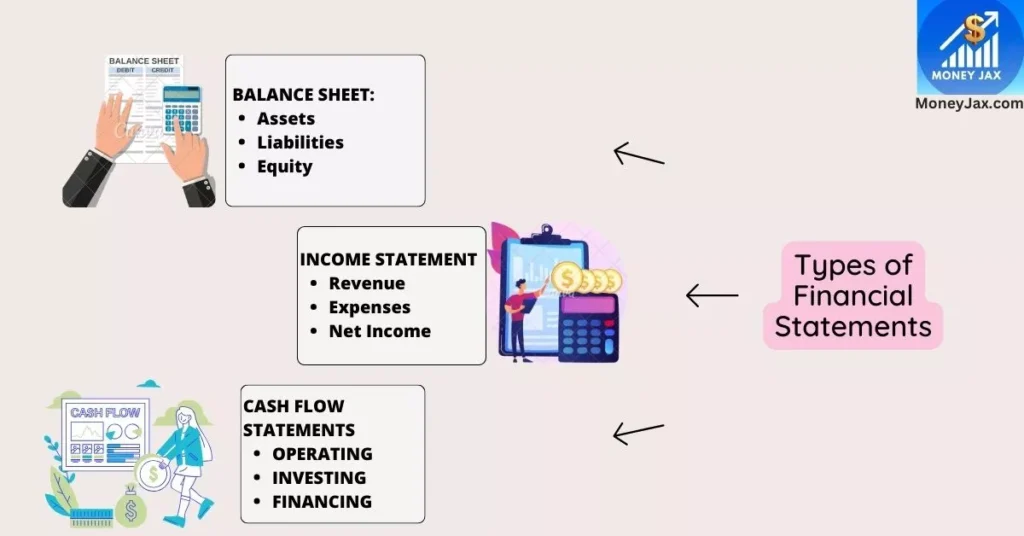

Types of Financial Statements

There are three main types of financial statements:

The Balance Sheet: A Snapshot of Financial Health

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial health at a specific point in time. It consists of three key sections:

- Assets: This section lists all the resources owned by the company, such as cash, inventory, equipment, and investments.

- Liabilities: Liabilities represent the company’s obligations, including loans, accounts payable, and other debts.

- Equity: Equity shows the owner’s interest in the company and is calculated as assets minus liabilities. It reflects the book value of the company.

The Income Statement: Profits and Losses

The income statement, also known as the profit and loss statement, reveals a company’s profitability over a specific period. It includes the following sections:

- Revenue: This is the total income generated from the company’s core operations, such as sales of products or services.

- Expenses: Expenses encompass all costs incurred to generate revenue, including salaries, rent, utilities, and advertising.

- Net Income: Net income is the difference between total revenue and total expenses. It represents the company’s profit or loss during the period.

The Cash Flow Statement: Following the Money

The cash flow statement provides insights into how cash is generated and used by a company during a specific period. It consists of three main categories:

- Operating Activities: This section details cash flows from the company’s core operations, such as cash received from customers and cash paid to suppliers.

- Investing Activities: Investing activities include cash flows related to buying and selling assets, such as property, equipment, and investments.

- Financing Activities: Financing activities involve cash flows related to borrowing, repaying loans, and issuing or repurchasing stock.

The Balance Sheet: A Deeper Dive

Let’s take a closer look at the components of the balance sheet: assets, liabilities, and equity.

Assets

Assets are what a company owns and uses to operate its business. They are classified into two main categories: current assets and non-current assets.

- Current Assets: Current assets are short-term assets that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable (money owed by customers), and inventory.

- Non-Current Assets: Non-current assets are long-term assets that are not expected to be converted into cash within one year. Examples include property, plant, equipment, and long-term investments.

Liabilities

Liabilities represent a company’s obligations to external parties. Like assets, they are classified into current liabilities and non-current liabilities.

- Current Liabilities: Current liabilities are debts and obligations that must be settled within one year. Examples include accounts payable (money owed to suppliers), short-term loans, and accrued expenses.

- Non-Current Liabilities: Non-current liabilities are long-term obligations that are not due for more than one year. Common examples include long-term loans, bonds, and deferred tax liabilities.

Equity

Equity, also known as shareholders’ equity or owner’s equity, represents the residual interest in the assets of a company after deducting liabilities. It is divided into two main components:

- Common Stock: Common stock represents the ownership shares held by shareholders. When investors purchase shares of a company’s common stock, they become partial owners of the business.

- Retained Earnings: Retained earnings are the accumulated profits or losses of a company that have not been distributed to shareholders as dividends. They are reinvested in the business to support growth.

The Income Statement: A Closer Look at Profits

The income statement provides a detailed view of a company’s revenues, expenses, and profits for a specific period. Understanding its components is crucial for assessing a company’s financial performance.

Revenue

Revenue, also known as sales or turnover, is the total income generated by a company’s primary operations. It includes income from the sale of goods, services, and any other revenue-generating activities. Revenue is often referred to as the “top line” because it is the first line item on the income statement.

Expenses

Expenses represent the costs incurred by a company to generate revenue and maintain its operations. These costs can be categorized into several subgroups, including:

- Cost of Goods Sold (COGS): COGS includes the direct costs associated with producing or purchasing the products or services that were sold during the reporting period. It includes materials, labor, and overhead.

- Operating Expenses: Operating expenses include day-to-day costs such as rent, utilities, salaries, advertising, and office supplies.

- Depreciation and Amortization: Depreciation represents the allocation of the cost of tangible assets (e.g., machinery, buildings) over their useful lives. Amortization is a similar concept but applies to intangible assets (e.g., patents, copyrights).

- Interest Expenses: Interest expenses arise from borrowing money, such as loans or bonds. Companies pay interest to creditors as compensation for using their funds.

- Taxes: Taxes can include income taxes, sales taxes, property taxes, and other taxes paid by the company.

Net Income

Net income, also known as profit or net earnings, is the bottom line of the income statement. It represents the amount of money a company has earned (or lost) after deducting all expenses, including taxes. Net income is a critical indicator of a company’s profitability and is often used by investors and analysts to assess its financial performance.

The Cash Flow Statement: Tracking the Money Trail

The cash flow statement is a dynamic financial statement that provides a clear picture of how cash moves in and out of a company during a specific period. It is divided into three main categories:

Operating Activities

Operating activities represent the cash flows generated by a company’s core business operations. These activities include:

- Cash received from customers for the sale of goods or services.

- Cash paid to suppliers for inventory and other expenses.

- Cash paid to employees in the form of salaries and benefits.

- Interest received and interest paid. v. Income taxes paid.

A positive cash flow from operating activities indicates that the company is generating cash from its primary operations, which is generally a positive sign.

Investing Activities

Investing activities involve cash flows related to the acquisition and disposal of long-term assets, including:

- Cash spent on the purchase of property, plant, and equipment (capital expenditures).

- Cash received from the sale of assets.

- Investments in securities, such as stocks and bonds.

- Receipts from loans made to other entities.

Investing activities can either consume or generate cash, depending on whether the company is acquiring or selling assets.

Financing Activities

Financing activities represent cash flows related to the company’s capital structure and financing sources, including:

- Cash received from issuing debt, such as loans or bonds.

- Cash paid to repay debt.

- Cash received from issuing equity, such as common stock.

- Cash paid as dividends to shareholders.

Analyzing financing activities helps assess how a company raises capital and manages its debt and equity.

Ratios: The Heart of Financial Statement Analysis

Financial ratios are powerful tools that allow stakeholders to assess a company’s performance, profitability, solvency, and efficiency. Let’s explore the key categories of financial ratios.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations using its current assets. Key liquidity ratios include:

- Current Ratio: This ratio compares current assets to current liabilities and assesses a company’s ability to cover short-term obligations. A ratio above 1 indicates liquidity.

- Quick Ratio (Acid-Test Ratio): The quick ratio excludes inventory from current assets to provide a more conservative measure of liquidity.

Profitability Ratios

Profitability ratios assess a company’s ability to generate profits relative to its revenue and expenses. Key profitability ratios include:

- Gross Profit Margin: This ratio measures the percentage of revenue that remains after deducting the cost of goods sold (COGS). It reflects a company’s pricing strategy and cost control.

- Net Profit Margin: The net profit margin represents the percentage of revenue that remains as net income after all expenses. It provides insight into a company’s overall profitability.

Solvency Ratios

Solvency ratios evaluate a company’s ability to meet its long-term obligations. Key solvency ratios include:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity and indicates the proportion of financing provided by debt. A lower ratio suggests lower financial risk.

- Interest Coverage Ratio: The interest coverage ratio measures a company’s ability to pay interest on its debt using its earnings before interest and taxes (EBIT). A higher ratio indicates better solvency.

Efficiency Ratios

Efficiency ratios assess how well a company utilizes its assets and manages its operations. Key efficiency ratios include:

- Inventory Turnover: This ratio measures how quickly a company sells its inventory. A high ratio suggests efficient inventory management.

- Accounts Receivable Turnover: The accounts receivable turnover ratio evaluates how quickly a company collects payments from customers. A higher ratio indicates efficient credit management.

Trend Analysis: Uncovering Patterns Over Time

Trend analysis involves examining a company’s financial statements over multiple periods to identify patterns and changes in performance. This analysis helps stakeholders understand whether a company is improving or deteriorating over time.

To conduct Trend analysis:

- Collect financial statements for multiple years (e.g., three to five years).

- Calculate key financial ratios for each year.

- Compare the ratios across years to identify trends.

- Look for consistent improvements or deteriorations in performance.

Trend analysis can reveal valuable insights about a company’s financial health and the effectiveness of its management strategies.

The Importance of Footnotes and Disclosures

Financial statements are typically accompanied by footnotes and disclosures that provide additional information and context. These notes can contain crucial details about accounting policies, significant events, and potential risks.

When conducting financial statement analysis, it’s essential to review the footnotes and disclosures carefully. They can shed light on issues that may not be apparent from the numbers alone.

Red Flags: Warning Signs in Financial Statements

While financial statements provide valuable insights, they can also reveal red flags or warning signs that signal potential problems within a company. Some common red flags to watch for include:

- Declining profitability over multiple periods.

- Rapidly increasing debt levels.

- Aggressive accounting practices, such as recognizing revenue prematurely or understating expenses.

- Frequent changes in accounting methods or restatements of financials.

- High levels of accounts receivable that remain uncollected.

- Significant related-party transactions that lack transparency.

Identifying red flags can help stakeholders make informed decisions and take appropriate action when necessary.

Limitations & Advantages of Financial Statement Analysis

| Advantages | Limitations |

|---|---|

| Risk Assessment: Identifies potential red flags and warning signs, allowing for early detection of financial risks and issues. | Historical Data: Financial statements provide historical data and may not reflect future performance accurately. |

| Informed Decision-Making: It provides crucial insights for investors, creditors, and business owners, aiding them in making well-informed financial decisions. | Accounting Assumptions: Financial statements are prepared based on accounting assumptions and estimates, which can vary between companies. |

| Performance Evaluation: Helps assess a company’s profitability, solvency, and efficiency over time, enabling stakeholders to track its financial health. | Non-Financial Factors: Financial statements may not capture non-financial factors such as management quality, market trends, or competitive dynamics. |

| Comparative Benchmarking: Facilitates comparisons with industry peers or competitors, aiding in competitive analysis and strategy development. | Comparability: Comparing financial statements across companies can be challenging due to differences in accounting methods. |

| Transparency and Accountability: Promotes transparency in financial reporting, fostering trust among stakeholders and ensuring corporate accountability. | Manipulation: Companies can manipulate financial statements to present a more favorable image, making it essential to exercise caution and verify information. |

Case Study: Analyzing a Company’s Financial Statements

To illustrate the practical application of financial statement analysis, let’s walk through a case study of a fictional company, XYZ Corporation.

XYZ Corporation: A Case Study in Financial Statement Analysis

Background: XYZ Corporation is a manufacturing company in the United States. We have obtained their financial statements for the past three years and will perform a comprehensive analysis to assess their financial health.

Step 1: Review the Financial Statements– Gather financial statements for the past three years (Balance Sheet, Income Statement, Cash Flow Statement).

Step 2: Calculate Key Financial Ratios

- Calculate liquidity ratios (e.g., current ratio, quick ratio).

- Calculate profitability ratios (e.g., gross profit margin, net profit margin).

- Calculate solvency ratios (e.g., debt-to-equity ratio, interest coverage ratio).

- Calculate efficiency ratios (e.g., inventory turnover, accounts receivable turnover).

Step 3: Conduct Trend Analysis

- Compare key financial ratios for each of the three years to identify trends.

- Note any significant improvements or deteriorations in performance.

Step 4: Perform Comparative Analysis

- Identify industry peers or competitors.

- Compare XYZ Corporation’s financial ratios to industry averages or those of its peers.

Step 5: Consider Common-Size Analysis– Express key line items on the income statement and balance sheet as percentages of total revenue.

Step 6: Investigate Red Flags-Look for any warning signs or red flags in the financial statements or footnotes.

Step 7: Assess Limitations– Acknowledge the limitations of financial statement analysis and consider other relevant factors.

Step 8: Make Informed Decisions– Based on the analysis, make informed decisions about XYZ Corporation’s financial health and performance.

By following these steps, stakeholders can gain valuable insights into XYZ Corporation’s financial condition and make informed decisions regarding investments, loans, or other financial transactions involving the company.

Conclusion: The Power of Informed Decision-Making

Financial statement analysis is a powerful tool that enables individuals and organizations to make informed decisions about investments, lending, and business operations. By understanding the components of financial statements, calculating key ratios, and conducting comprehensive analyses, stakeholders can assess a company’s financial health, profitability, and long-term sustainability.

In a world where financial information is abundant, the ability to interpret and analyze financial statements is a valuable skill. Whether you’re an investor looking to make wise investment choices, a creditor evaluating a loan application, or a business owner seeking to optimize financial performance, financial statement analysis can provide the insights needed to navigate the complex financial landscape effectively.

In conclusion, financial statement analysis empowers individuals and organizations to make informed financial decisions, ultimately contributing to a more financially secure and prosperous future.

Also Read- Understanding U.S. Treasury Debt in 2023: A Comprehensive Overview

Frequently Asked Questions

What are financial statements?

Financial statements are essential documents summarizing a company’s financial performance, including the balance sheet, income statement, and cash flow statement.

Why are liquidity ratios crucial in financial analysis?

Liquidity ratios like the current and quick ratios assess a company’s ability to meet short-term obligations, providing insights into its financial stability.

How can trend analysis benefit investors?

Trend analysis helps investors identify consistent performance patterns in a company’s financial statements over multiple years, aiding in informed investment decisions.

Why is comparative analysis important for businesses?

Comparative analysis enables businesses to benchmark their financial performance against industry peers, helping them identify areas for improvement.

What are the limitations of financial statement analysis?

Limitations include reliance on historical data, variations in accounting assumptions, and the inability to capture non-financial factors, necessitating caution and supplementary information in decision-making.