For your tremendous journey of investments in various companies in the US markets, the finance Yahoo earnings calendar can be your handy tool. This can help you stay ahead of the curve and get timely insights by being your guide for better corporate performance. The calendar lets you access many features and paves the right path for investing even if you are a mere beginner in the field. Let us have a closer look at all the features, pros, cons, and competitors of the finance Yahoo earnings Calendar.

What is a Finance Yahoo Earnings Calendar?

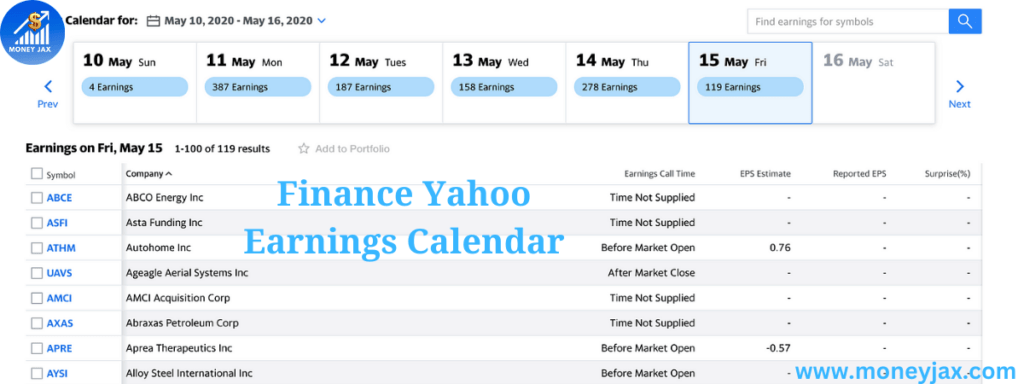

An earnings calendar is a tool that helps one track the financial status of various companies from around the US markets. The calendars have the quarterly and annual financial results with the earnings reports for a specific range of dates.

The finance Yahoo earnings calendar is a free online tool for investors to be informed of the schedule for earnings report releases for publicly traded companies on US exchanges or actively trading companies.

Finance Yahoo Earnings Calendar Features

In the finance Yahoo earnings calendar, you can get several features to analyze the market. A few of the features you would want to check out are discussed here:

Navigation

The various navigation choices you can get are as follows:

- Filter by Date – This lets you view the financial earnings report based on a certain date or those in between a specific date range.

- Filter by Sector – Using Yahoo Earnings Calendar you can explore companies based on sector or their industry.

- Filter by Symbol – This feature is very useful if you want to search for companies based on their ticker symbols. Ticker symbols are unique identifiers assigned to publicly traded companies on stock exchanges and are generally 1-5 letters long.

- Sort results – This lets you arrange the list based on market cap, alphabetically, chronologically by date, time, or earnings.

- Historical Data – Past releases of earnings by companies often are analyzed to identify trends and patterns. This can be accessed using the view historical data feature.

Investor Types

You can explore the calendar based on the type of investor you are to get customized options and features tailored to your possible needs. You can be any one of the following investors:

- Long-term Investor – This view lets you track portfolio companies, evaluate their performance, and make decisions based on this information.

- Day traders – Use this view if you are a day trader trying to identify potential short-term trading opportunities. The fields to look out for are primarily the earnings surprises and the market reactions.

- Swing Traders – Suppose you are interested in analyzing the trends over days or weeks and want to make strategic moves based on the earnings, then you can use this view.

- Fundamental Analysts – You can make use of the ESP figures and earnings surprises to analyze the financial health of companies and make investment recommendations based on them.

Customization

These are the set of features that you use or enable based on your requirements.

- Creating Watchlists – A list of companies can be made with those you want to track in the finance Yahoo earnings calendar. This gets you an organized interface with relevant updates and information based on your interests that lets you stay focused on your financial goals.

- Set Alerts – This feature lets you get notified when the companies in your watchlist are about to release the earnings report. You can receive the notifications via email or the mobile app.

- Export Data – For further analysis and future use or integration with other tools, you can download the data in the finance Yahoo earnings calendar in either CVS or Excel format.

Information provided

Let us look into the information displayed in the Yahoo earnings calendar.

- Company Name – This field in the calendar displays the name of the company releasing the report.

- Ticker Symbol – This field displays the unique stock market identifier for the company for easy tracking.

- Earnings Date – This is the most relevant field in the whole calendar as the date on which the company’s upcoming earnings release is scheduled will be displayed here.

- Expected EPS – Earnings per share (EPS) which is the estimate for the company’s earnings for each share, is displayed in this field. This is not an accurate value as it is an estimate based on the data collected so far.

- Earnings Surprise – This is a metric used by analysts to see the company’s performance. The value lets you understand if the company’s finances have met the expectations, missed them, or have gone further above them.

- Previous Quarter EPS – This lets you evaluate the current EPS of the company based on the previous quarter’s earnings.

Finance Yahoo Earnings Calendar Benefits

The uses or benefits of using the Finance Yahoo earnings calendar are as follows:

- Staying Informed

Stock price movements are crucial for any trader or investor in finance, and earnings releases can be a major catalyst for it. In order to make the right move and never miss any opportunities, you should be aware of the upcoming events that are related to investments, and the Finance Yahoo earnings calendar can help you with the same. - Identify opportunities for trade

Carefully using the Yahoo earnings calendar can help you identify short-term trading opportunities. This includes its usage to identify the companies that are likely to go above or beyond the expectations of analysts. - Informed investment decision making

The expected EPS can be a useful metric for measuring the market’s expectations on the performance of the company. The decision on whether to buy, sell, or hold a stock can be made based on this information. - Timely Alerts

Finance Yahoo earnings calendar lets you set up alerts for when a particular company that you are interested in is about to release its earnings reports. This in turn helps you analyse facts right on time and never miss an earnings report release. - Integration with Yahoo Finance

Rather than being an earnings calendar, the finance Yahoo earnings calendar provides seamless access to additional financial data and resources with the Yahoo finance platform.

Strategies in Finance Yahoo Earnings Calendar

Being an investor, to make the most profitable moves, you need to choose the right strategies. This highly depends on the investor type you belong to. The strategies to imply for various investor types are :

- Long-term Investor

- Track portfolio companies: Keep monitoring upcoming earnings releases to analyze the performance of companies and consider adjustments in investments if necessary.

- Identify undervalued companies: Find the potentially undervalued companies by comparing the EPS to current stock prices. Investing in these companies is likely to generate a good profit.

- Confirm growth trends: Check for consistent earning beats to evaluate a company’s growth potential.

- Plan reinvestments: Track the earnings date of companies to plan reinvestments.

- Track portfolio companies: Keep monitoring upcoming earnings releases to analyze the performance of companies and consider adjustments in investments if necessary.

- Day Traders

- Use earnings surprises: Identify companies that would probably beat the expectations and choose them to make short-term price movements.

- Capitalize on volatility: Be fully aware of the volatile nature of earnings release in the market and set entry and exit points accordingly.

- Use options contracts: There are various options strategies like the calls and puts which can be used to profit from anticipated moves.

- Combine data with technical analysis: Bring together the earnings data with the chart patterns and indicators for confirmation signals before an investment.

- Use earnings surprises: Identify companies that would probably beat the expectations and choose them to make short-term price movements.

- Swing Traders

- Hold through earnings: On being confident in a company’s performance, choose to hold on to it through the potential volatility as this could eventually bring you long-term earnings.

- Gradually scale in/out: Make entry or exit positions over days or weeks based on the careful analysis of pre and post-earnings analysis.

- Carefully manage risk: Due to the fluctuations of the market, earnings might disappoint you at times. During times like these to limit potential losses, set stop-loss orders.

- Combine with fundamental analysis: Look at the broader picture including the industry trends and current company affairs in addition to the earnings data.

- Hold through earnings: On being confident in a company’s performance, choose to hold on to it through the potential volatility as this could eventually bring you long-term earnings.

Finance Yahoo Earnings Calendar Limitations

Despite being an effective tool for investors, the finance Yahoo earnings calendar has several limitations such as:

- Estimated ESP

- Limited coverage

- Last-minute changes

- Technical issues

- Delays

On considering the right measures, these limitations can be mitigated. This includes cross-referencing with reliable sources such as company websites, seeking advice from finance professionals, managing risk, diversifying investments, and so on.

Alternatives to Finance Yahoo Earnings Calendar

- NASDAQ Calendar

These calendars are a comprehensive coverage of various US-listed companies across major exchanges, including Nasdaq, NYSE, and AMEX. This is a better option if you are seeking detailed data and analysis of the tech sector or the Nasdaq-listed companies. - MarketWatch Calendar

MarketWatch calendars are useful for investors who focus on news integration and prefer a clear view of earnings. It has a minimalistic and visually appealing interface along with a set of basic features.

Pro tips for Finance Yahoo Earnings Calendar

- Bookmark frequently used filters

This can save you a great deal of time as well as keep track of your favorite filters. - Set alerts strategically

These can give you the right information at the right time. - Analyse historical data

Consider the financial history of companies to decode the patterns and future performance and hence make informed decisions. - Visualize earnings

Use the calendar’s visual tools such as the charts and graphs to see the upcoming earnings releases more intuitively. Also, use the interactive elements for a better experience. - Don’t rely solely on EPS

Other factors like economic data, company news, and industry trends are to be considered as EPS is an estimated value and might differ.

Conclusion

Even though there exist several tools for investors even with the earnings calendars, finance Yahoo earnings calendars stand out from the rest with a very user-friendly interface and numerous customization options for diverse investor types irrespective of the experience they have. Comprehensive data is provided with options to export the calendar data and numerous features without a premium subscription.

Therefore the finance Yahoo earnings calendar has several strengths that outweigh its limitations and is a valuable resource for tracking upcoming earnings reports, analyzing company performance, and identifying potential investment opportunities.

Also Read– The Rise and Future of PayPal: A Yahoo Finance Perspective in 2024

Atom Finance: Review 2024

Frequently Asked Questions

Are the Earnings Calendar free to use?

Yes, the earnings calendar is a completely free trading tool. There are various providers or platforms offering this tool like Yahoo, Nasdaq, and MarketWatch

Are the expected EPS figures always accurate?

No, the figures shown by the earnings calendar are mere estimates and not actual values. The real financial values of companies may vary.

Does the calendar include all publicly traded companies?

No, the Finance Yahoo earnings calendar mainly focuses on the actively traded companies and those listed on the major US exchanges like the New York Stock Exchange (NYSE), Nasdaq, and American Stock Exchange (AMEX).

Life is a journey, and finances are a big part of that ride. I’m Neerthu, and I believe everyone deserves to feel confident and empowered about their money. Whether you’re a seasoned investor or just starting out, I’m here to share my insights, experiences, and money mistakes with practical takeaways made from the current finance affairs along the way. Join me as we demystify financial planning, debunk common myths, and make smart money moves together.