Retirement planning is a journey that everyone should embark upon, and at the heart of a successful retirement plan lie your financial assets. In the United States, where the responsibility for retirement funding increasingly rests on individuals, understanding how to leverage your Financial assets is essential. This blog post will guide you through the crucial role financial assets play in securing your future during retirement.

The Shifting Landscape of Retirement Planning

Gone are the days when retirees could rely solely on pensions and Social Security to fund their retirement. Today, individuals are expected to take a more active role in planning for their financial security during their golden years. This shift underscores the importance of financial assets in retirement planning.

What Are Financial Assets?

Financial assets encompass a wide range of investments and holdings that have the potential to generate income and appreciate in value. In the context of retirement planning in the US, they commonly include:

- Stocks and Equities: Owning shares in companies provides the opportunity for capital appreciation and dividends.

- Bonds: Fixed-income securities offer stability and regular interest payments.

- Savings Accounts and Certificates of Deposit (CDs): These provide liquidity and safety for emergency funds and short-term goals.

- Real Estate: Property holdings can generate rental income and appreciate over time.

- Retirement Accounts (e.g., 401(k), IRA): Tax-advantaged accounts specifically designed for retirement savings.

- Mutual Funds and Exchange-Traded Funds (ETFs): Diversified investment options that pool money from multiple investors.

The Wealth-Building Potential of Financial Assets

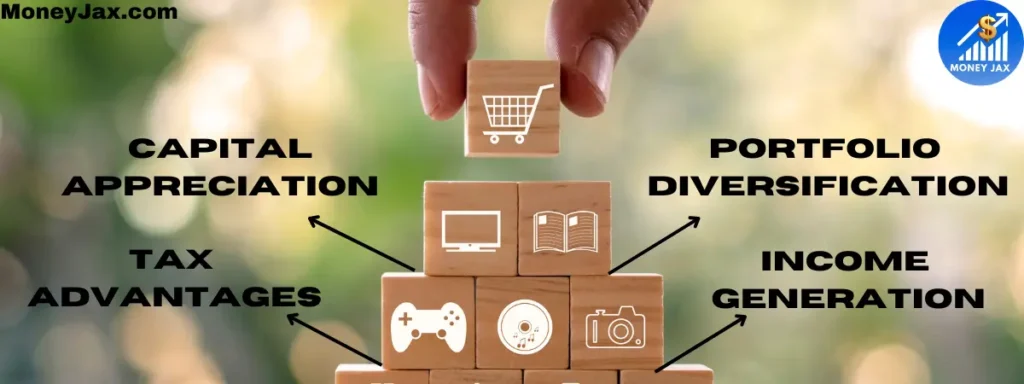

Financial assets have a compelling wealth-building potential due to several key factors:

- Capital Appreciation: Many financial assets, such as stocks and real estate, have the potential to increase in value over time. This capital appreciation allows your investments to grow, increasing your net worth.

- Income Generation: Certain financial assets, including bonds, dividend-paying stocks, and rental properties, can provide regular income streams. These income sources can help you meet your financial needs and goals.

- Tax Advantages: The United States offers tax-advantaged retirement accounts like 401(k)s and IRAs. Contributions to these accounts are often tax-deductible, and the earnings within them can grow tax-deferred or tax-free, significantly enhancing your wealth-building potential.

- Portfolio Diversification: Diversifying your assets by holding a mix of investments can spread risk and reduce the impact of market volatility. This diversification strategy enhances the stability of your portfolio.

Tailoring Financial Assets to Your Goals

The types of financial assets you choose should align with your financial goals, risk tolerance, and investment horizon:

- Short-Term Goals: If your financial objective is to achieve short-term goals, such as building an emergency fund or saving for a vacation, consider safer and more liquid options like savings accounts, money market accounts, or short-term bonds.

- Long-Term Growth: For those aiming for long-term wealth accumulation, investing in assets with growth potential, such as stocks, is often advisable. A long investment horizon can withstand market fluctuations and capitalize on the power of compounding.

- Retirement Planning: Retirement accounts, such as 401(k)s and IRAs, are tailor-made for long-term retirement savings. By contributing consistently to these accounts and strategically investing, you can build a substantial nest egg for your retirement years while enjoying tax advantages.

Managing and Protecting Your Financial Assets

Successful wealth accumulation and asset protection involve prudent financial management:

- Regular Monitoring: Keep a vigilant eye on your investments and financial assets. Periodically review your portfolio to ensure it aligns with your goals and risk tolerance. Market conditions, economic changes, and personal circumstances may necessitate adjustments.

- Risk Management: Understand the level of risk associated with your financial assets. While higher-risk assets like stocks offer growth potential, they can also be subject to greater volatility. Diversify your portfolio to spread risk across different asset classes.

- Asset Protection: Protect your financial assets through insurance and estate planning. Insurance coverage can shield your assets from unexpected events, while estate planning ensures your assets are transferred according to your wishes.

The Role of Financial Assets in Retirement Planning

- Income Generation: Financial assets can generate income streams during retirement. Dividends from stocks, interest from bonds, and rental income from real estate can supplement your retirement income.

- Capital Appreciation: Over time, well-chosen assets have the potential to grow in value. This can help you combat the erosive effects of inflation and maintain your purchasing power.

- Portfolio Diversification: Diversifying your financial assets can help spread risk and enhance stability. A mix of stocks, bonds, and other investments can help protect your retirement savings from market volatility.

- Tax Efficiency: Certain financial assets, like retirement accounts (e.g., IRAs and 401(k)s), offer tax advantages, allowing you to grow your savings more efficiently.

Retirement planning is a crucial aspect of financial management that individuals should prioritize to ensure a secure and comfortable retirement. It involves strategic decision-making and financial preparations to meet one’s financial goals during the post-employment years. The process begins with a thorough assessment of current financial standing, future expectations, and desired lifestyle.

One key aspect of retirement planning is setting aside a portion of one’s income for long-term savings and investments. By utilizing tools such as retirement accounts, individuals can benefit from tax advantages while building a nest egg for the future. These accounts, such as 401(k)s or IRAs, provide a structured and disciplined approach to saving for retirement.

Considerations for Retirement-Ready Financial Assets

- Risk Tolerance: Assess your risk tolerance and align your assets accordingly. Younger individuals may opt for more aggressive investments, while those closer to retirement might prioritize stability.

- Diversification: Build a diversified portfolio to reduce risk. Consult with a financial advisor to create a strategy that suits your goals and risk tolerance.

- Income Streams: Ensure that your assets are structured to provide reliable income during retirement. Consider dividend stocks, bonds with predictable yields, and income-generating real estate.

Ongoing Monitoring and Adjustment

Retirement planning is not a set-and-forget endeavor. Regularly review your financial assets and adjust your portfolio as needed. As you approach retirement, you may shift toward more conservative investments to protect your nest egg.

Conclusion

In the United States, the path to a secure retirement increasingly relies on individual initiative and the effective use of financial assets. By understanding the role of assets in retirement planning and making informed decisions, you can take control of your financial future and work towards a comfortable and fulfilling retirement. Consult with a financial advisor to create a tailored retirement plan that leverages your financial assets for long-term success. Your future self will thank you for it.

Financial assets are the tools that can turn your financial dreams into reality. Whether your aspirations involve retiring comfortably, purchasing a home, funding your children’s education, or achieving financial independence, understanding how to leverage assets is paramount. By carefully selecting and managing your financial assets in alignment with your goals and risk tolerance, you can pave the way to a prosperous financial future in the USA.

For personalized guidance and to create a customized financial plan that optimizes your assets for success, consider consulting with a certified financial advisor or planner. These professionals can provide expert insights and strategies tailored to your unique financial situation and objectives.

Remember, your financial journey is a marathon, not a sprint. With patience, discipline, and a well-structured approach to financial asset management, you can navigate the complexities of the financial landscape and build lasting wealth for yourself and your loved ones.

Also Read:https://moneyjax.com/financial-analysis/

Frequently Asked Questions:

What are financial assets, and why are they important in retirement planning?

Assets are investments or holdings with intrinsic monetary value that can generate income or appreciate over time. They are important in retirement planning because they provide a means to generate income during retirement, protect against inflation, and grow your savings over the years.

How do I determine the right mix of financial assets for my retirement portfolio?

The right mix of assets depends on your financial goals, risk tolerance, and time horizon. A diversified portfolio that includes stocks, bonds, and other assets can help manage risk while aiming for growth and income.

Are there specific financial assets that are best suited for retirement planning in the United States?

While the ideal mix of assets varies from person to person, tax-advantaged retirement accounts (e.g., 401(k)s and IRAs) are commonly used in the US due to their tax benefits. Additionally, a combination of stocks, bonds, and other income-generating assets is often recommended.

How can I use financial assets to generate income in retirement?

Assets like dividend-paying stocks, bonds, annuities, and rental properties can provide regular income during retirement. Careful planning and asset allocation can help ensure a steady income stream.

What role do tax considerations play when using financial assets in retirement planning?

Taxes can significantly impact your retirement income. Understanding the tax implications of different assets, as well as strategies for tax-efficient withdrawals, is crucial for maximizing your retirement savings.