In today’s complex and ever-changing economic landscape, Financial Education is more crucial than ever before. It’s not just about managing your bank account or paying bills on time; it’s about understanding the fundamentals of finance and making informed decisions that can shape your financial future.

Financial education is a cornerstone of personal and societal well-being. In the United States, the need for financial literacy has never been more critical than it is today. With the complexities of modern financial systems, the burden of managing one’s finances falls largely on the individual. However, a significant portion of the population lacks the necessary knowledge and skills to make informed financial decisions. In this article, we will explore the significance of financial education in the United States, its current state, and the steps that can be taken to improve it.

What is Financial Education

Financial education encompasses a broad range of knowledge and skills related to managing money, making informed financial decisions, and achieving financial goals. At its core, it is about equipping individuals with the tools they need to navigate the complex world of personal finance effectively.

- Basic Financial Literacy: Financial education starts with teaching individuals the fundamentals of money management, including concepts like budgeting, saving, and understanding financial statements. It provides the foundation for more advanced financial knowledge.

- Investment Knowledge: Financial education goes beyond saving money in a bank account; it includes understanding investment options like stocks, bonds, mutual funds, and real estate. It teaches individuals how to assess risk, make informed investment choices, and grow their wealth over time.

- Debt Management: Knowing how to manage and responsibly use credit is a crucial aspect. It covers topics such as credit scores, interest rates, and strategies for reducing and eliminating debt.

- Retirement Planning: Planning for retirement is a significant part of financial education. It includes understanding retirement accounts (e.g., 401(k), IRA), estimating retirement needs, and making contributions to ensure a comfortable retirement.

- Economic Literacy: It’s essential to understand economic concepts like inflation, interest rates, and how economic conditions can impact personal finances.

- Critical Thinking and Decision-Making: Financial education encourages individuals to think critically about financial choices, evaluate risks and rewards, and make decisions that align with their financial goals and values.

Financial education, therefore, encompasses a comprehensive understanding of financial concepts, practical skills, and the ability to apply this knowledge to real-life financial situations. It is not only about knowing what to do but also about developing the confidence and discipline to make sound financial choices throughout one’s life.

Financial education is a crucial aspect of personal development, empowering individuals with the knowledge and skills necessary to make informed and responsible financial decisions. In today’s dynamic economic landscape, where financial choices abound, acquiring financial literacy is more important than ever.

Through comprehensive financial education, individuals gain an understanding of fundamental concepts such as budgeting, saving, investing, and debt management. This knowledge equips them to navigate the complexities of personal finance, enabling the establishment of sound financial habits and long-term stability.

The State of Financial Education in America

Financial education in the United States, or the lack thereof, is a topic that often falls through the cracks of public discourse. Many Americans, even those with advanced degrees, lack the essential financial knowledge to navigate the complexities of modern finance. The statistics paint a concerning picture:

- Lack of Formal Education: Financial education is not a mandatory part of the K-12 curriculum in most states. Although some states have introduced financial literacy programs, they are often optional or inconsistent. This means that many young adults enter the world without a fundamental understanding of financial principles.

- The Debt Epidemic: The United States has an alarming consumer debt problem. According to the Federal Reserve, as of 2021, American households collectively held over $14.96 trillion in debt, including mortgages, credit cards, and student loans. The lack of education plays a significant role in this crisis.

- Savings Crisis: A 2020 Bankrate survey found that 21% of Americans don’t have any savings at all, and only 41% have enough savings to cover a $1,000 emergency expense. This inability to save stems from a lack of understanding about the importance of saving and effective strategies for doing so.

- Retirement Preparedness: The National Institute on Retirement Security reports that nearly 40 million working-age households (45%) have no retirement savings. A lack of retirement planning and investing knowledge is at the heart of this issue.

- Student Loan Burden: As of 2021, outstanding student loan debt in the United States exceeded $1.7 trillion. Many borrowers struggle to manage their loans due to insufficient knowledge about repayment options and interest rates.

- Investment Ignorance: Many Americans shy away from investing because they lack the knowledge and confidence to do so. Consequently, they miss out on opportunities to grow their wealth and secure their financial future.

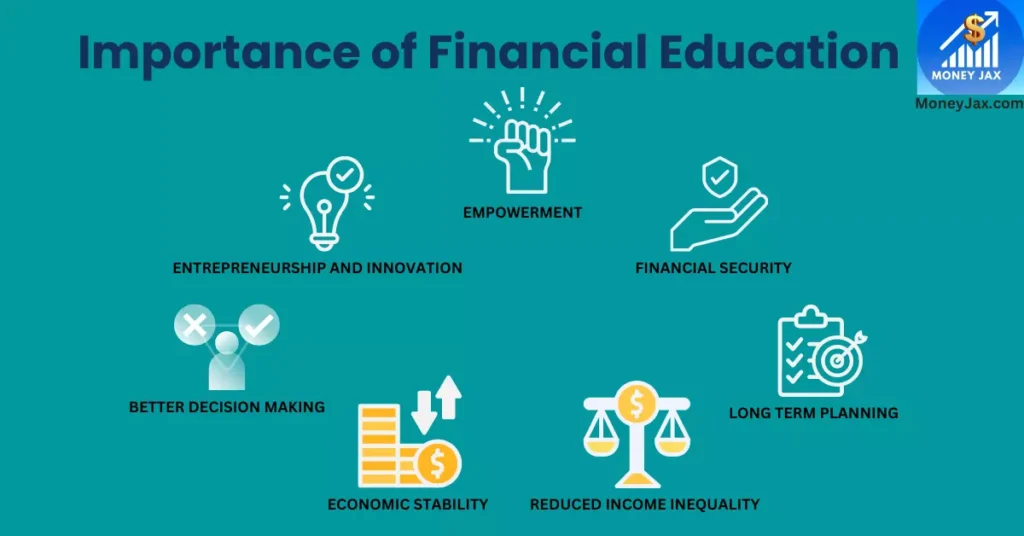

The Importance of Financial Education

Financial education is not a luxury; it is a necessity. Here are several reasons why it is crucial for individuals and society as a whole:

Empowerment: It empowers individuals to take control of their financial futures. It provides them with the knowledge and tools to make informed decisions about saving, spending, and investing.

Financial Security: An understanding of financial principles can lead to greater financial security. It helps individuals avoid high-interest debt, build emergency funds, and plan for retirement.

Economic Stability: A financially literate population contributes to economic stability. When individuals make sound financial decisions, they are less likely to default on loans or require government assistance.

Reduced Income Inequality: Financial education can play a role in reducing income inequality by equipping individuals with the skills to increase their earning potential and manage their resources effectively.

Entrepreneurship and Innovation: Financial education encourages entrepreneurship and innovation. When individuals understand how to manage their finances, they are more likely to take calculated risks and start their own businesses.

Better Decision-Making: Financial literacy goes beyond personal finance; it extends to critical thinking and decision-making skills. These skills are invaluable in all aspects of life.

Long-Term Planning: It encourages long-term thinking and planning. It helps individuals set and achieve financial goals, whether that be buying a home, sending a child to college, or retiring comfortably.

Challenges to Financial Education

While the benefits of financial education are clear, several challenges hinder its widespread implementation and effectiveness in the United States:

- Lack of Standardization: The absence of standardized financial education curriculum across states means that the quality and content can vary widely. Standardization would ensure that all students receive a consistent level of education.

- Teacher Training: Many educators do not have the necessary training or resources to effectively teach financial literacy. Teacher training programs and resources are essential to address this issue.

- Access to Resources: Not all communities have equal access to financial education resources. Low-income neighborhoods and rural areas may lack the infrastructure and programs needed to deliver financial education effectively.

- Digital Divide: In an increasingly digital world, the digital divide presents a significant challenge. Access to online financial education resources is not universal, leaving some individuals at a disadvantage.

- Engagement and Relevance: Traditional financial literacy programs may struggle to engage students, particularly younger generations. Making financial education relevant and interactive is crucial to capturing their interest.

Steps Toward Improved Financial Education

To address these challenges and improve financial education in the United States, several steps can be taken:

Standardized Curriculum: States should work toward a standardized financial education curriculum that covers essential topics at various grade levels. This ensures that all students receive a consistent and comprehensive education.

Teacher Training: Invest in teacher training programs to equip educators with the knowledge and skills to teach financial literacy effectively. This may involve partnerships with universities and organizations specializing in financial education.

Community Outreach: Develop community-based financial education initiatives to reach underserved populations. These programs can provide resources and support tailored to the specific needs of each community.

Leveraging Technology: Utilize technology to make financial education more accessible and engaging. Online courses, mobile apps, and interactive platforms can reach a broader audience.

Financial Education in the Workplace: Employers can play a role by offering financial education programs to their employees. This can help individuals make better financial decisions and reduce financial stress.

Public Awareness Campaigns: Launch public awareness campaigns to highlight the importance of financial education and encourage individuals to seek out resources. These campaigns can be conducted through various media channels.

Incorporate Financial Education into Existing Programs: Financial education can be integrated into existing subjects like math, social studies, and economics. This approach reinforces financial literacy while aligning with the current educational framework.

Collaboration: Encourage collaboration between government agencies, non-profit organizations, financial institutions, and schools to pool resources and expertise in promoting financial education.

Evaluation and Improvement: Continuously assess the effectiveness of finance education programs and curricula. Make necessary adjustments based on feedback and outcomes.

The Role of Parents and Guardians

While schools and institutions have a vital role in promoting financial education, parents and guardians are also crucial in shaping a child’s financial behavior. Here are some ways in which parents can contribute to their child:

- Lead by Example: Children often learn by observing their parents’ financial habits. Demonstrating responsible financial behavior sets a positive example.

- Open Communication: Encourage open and age-appropriate discussions about money. Answer questions honestly and use everyday situations to teach financial concepts.

- Allowance and Budgeting: Give children an allowance and guide them in creating a budget. This helps them understand the value of money and practice budgeting from an early age.

- Savings and Goals: Encourage children to save a portion of their allowance or earnings. Help them set savings goals, such as saving for a toy or a future event.

- Shopping and Comparisons: Involve children in shopping trips and teach them how to compare prices, read labels, and make informed purchasing decisions.

- Banking Basics: Introduce children to the concept of banks, savings accounts, and interest. Take them to the bank to see how it works.

The Need for Lifelong Learning

Financial education is not a one-time event but a lifelong journey. Even those with a solid foundation in financial literacy can benefit from ongoing learning. Key points to consider:

- Adapting to Economic Changes: The financial landscape continually evolves. Ongoing education helps individuals adapt to economic shifts, such as the rise of digital currencies or changing investment trends.

- Financial Wellness: Promoting financial wellness means not just focusing on traditional education but also on emotional and psychological aspects of financial well-being.

- Access to Resources: Accessible and affordable resources, both online and offline, should be available to help individuals of all ages continue their financial education.

The Role of Technology

In today’s digital age, technology plays a crucial role in advancing financial education:

- Online Learning Platforms: The internet offers a wealth of resources, from educational websites and apps to video tutorials, that make financial literacy more accessible.

- Financial Apps: There is a growing market of financial apps and tools that can help individuals budget, save, invest, and track their financial progress.

- Robo-Advisors: Automated investment platforms provide an accessible entry point for those new to investing.

- Blockchain and Cryptocurrency: Understanding emerging technologies like blockchain and cryptocurrency is increasingly important as they reshape the financial industry.

Learn more about Financial Education

Conclusion

Financial education is not a luxury but a necessity in today’s world. It empowers individuals to make informed financial decisions, build wealth, and secure their financial future. The current state of financial education in the United States leaves much to be desired, but there are clear steps that can be taken by governments, institutions, and individuals to improve it.

By standardizing curriculum, training teachers, and leveraging technology, we can ensure that it reaches all Americans, from a young age through adulthood. The goal is to build a financially literate America where every individual has the knowledge and tools to make sound financial choices, ultimately leading to a more prosperous and financially secure future for all.

Also Read- Personal Finance for Beginners: Building a Strong Financial Foundation in 2023

Frequently Asked Questions

What is the current state of financial education in the United States?

The current state of financial education varies widely across states and lacks standardization, resulting in unequal access.

Why is financial education important?

Financial education empowers individuals to make informed decisions, build wealth, and achieve financial security.

What role should the government play in promoting financial education?

The government should fund and implement comprehensive financial education programs in schools and standardize curriculum.

How can technology contribute to financial education?

Technology offers online resources, financial apps, and automated tools to enhance accessibility and learning opportunities.

What is the key to building a financially literate America?

Building a financially literate America requires collective efforts, including involvement at home, community initiatives, and advocacy for increased financial education.