The major problem arising these days is financial literacy. It is always a good decision to have prior knowledge of things we might get engaged with in the future. The sooner we begin the better it is for our future. Financial literacy for beginners might be a tough call, but it is never too late to start with new things.

Managing finances is one of the major tasks and money is one of the most important aspects of our lives. Initially, the whole concept might frighten you but educating yourself about it can bring that confidence in you. Investing, budgeting, banking, credit, and debt are the bases of your financial decisions. There are many things you must take care of when you enter the circle of finances. Stepping into this world can be quite intimidating and one might get into a situation of perplex to initiate the first step. But this guide covers all the aspects of financial literacy for beginners.

What is Financial Literacy?

Financial literacy is an empirical understanding and application of financial skills in a constructive manner. Skills that incorporate financial literacy are budgeting, investing, borrowing, saving, spending, taxation and personal finance management.

A person who is not aware of such skills can be called as financially illiterate. That is why financial literacy for beginners is really important. It allows a person to become self-aware and self-sufficient about his finances and saves him from future economic distress.

The Financial Industry Regulatory Authority (FINRA) claims that approximately 66% of the American population is lagging in financial literacy. Financial literacy for beginners is crucial as several aspects influence the day-to-day life of an individual. These aspects may include, student loans, investments, mortgages and credit etc.

Key components of financial literacy for beginners

- Earning

- Budgeting

- Saving

- Investing

- Money spent

- Borrowing

- Managing debt

- Protecting assets

Understanding the need for financial literacy for beginners

Financial literacy promises a prolonged financially stable life. An individual can ensure a stress-free life.

Below are some important facts that must draw your attention towards the importance of financial literacy for beginners.

- According to reports the credit card debt levels have hiked to $1.04 trillion.

- Over 189 million Americans hold a credit card.

- Each credit card owner owns 4 cards on average.

- The estimation says that 78% of the American population lives paycheck to paycheck.

- The student loan debt is about $1.5 trillion.

- There are more than 44 million borrowers for student loans.

The overall conclusion that can be drawn by looking at these facts is that about $12.58 trillion of the American population is in debt. From here one can sum up the need for financial literacy for beginners.

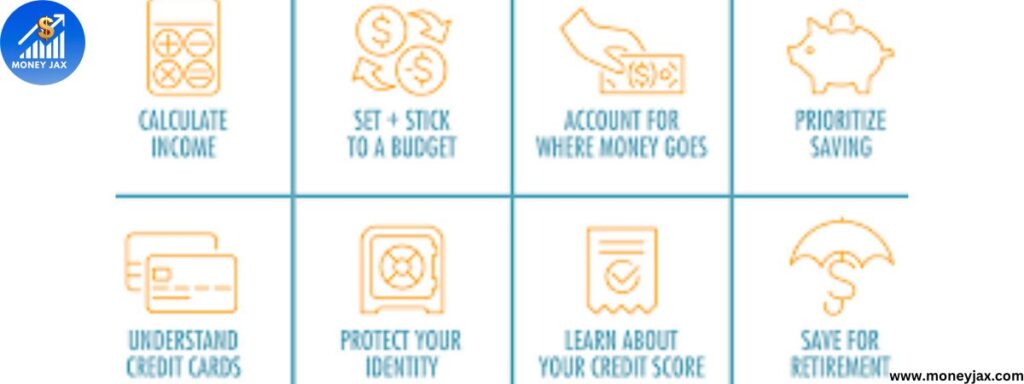

Initial steps to promote financial literacy for beginners

- Read about it: The more knowledge you will hold about things the easier it will be for you to deal with things. Reading the section for finances in the newspaper daily can easily help you out with a basic understanding. Further, you can move out of your comfort zone and start with other magazines and journals. And what is better than the internet? you can always rely on it for any related queries.

- Use of financial management tools: Several financial management apps help you with your finances. Along with that, they offer you tutorials, and smart tips on how to manage your finances. These also help you schedule your payments as well as investments. This way you can stop living paycheck to paycheck.

- Get expert advice: To get your basics in line one can straight away avail services from financial institutions. These institutions are reliable and the staff is there to help you understand the financial literacy for beginners and get you right on track. Some agencies also help you make a budget, clear out your debts and ensure future financial security. However, these all services are charged by the agencies.

- Increase familiarity with your finances: financial literacy for beginners depends on an individual’s mindset and habits. The best way to test your learned skills is by applying them in your daily life. Keeping an account of personal finances is the most basic and important step towards financial literacy for beginners. Thus, it is imperative to make your budget, manage your credit and debt and plan for a safe future.

- Mymoney.gov. : It is a financial website created by the U.S. Department of the Treasury’s Financial Literacy and Education Commission

- Investor.gov: The U.S. Securities and Exchange Commission created this website to help readers learn more about how to invest and protect their investments.

- Consumer education: A section of the CFPB website provides readers with tools and information to help them make more informed financial decisions.

- Consumer advice: The Federal Trade Commission created this website to help readers avoid scams, learn how to report fraud and educate themselves about finances.

- Learn & grow: It is a section of Capital One’s website featuring helpful articles specifically targeting helping readers gain a better understanding of a wide variety of personal finance topics.

Learn how to make a budget

A better budget helps you appropriately regulate your money. When you plan for a good budget you spend accordingly and turn out to save more than usual. This saved money can be of great use in the future or in cases when you run out of your pockets. Budgeting ensures that you don’t spend unnecessarily and create a space for savings.

The first step is to make a note of your monthly income and track your expenditures. All fixed expenditures such as a mortgage, rent, loan payments, bills, etc. should be included. Other than that variable expenses such as groceries and entertainment etc. should also be included.

Based on the kind of expenses that you make you can segregate your goals into two categories: short-term goals and long-term goals. Short-term goals include the kind of goals that you can achieve in a year while long-term goals include goals such as retirement savings etc. basically those goals that require more than a year.

The 50/30/20 rule: how to budget your money more efficiently

The 50/30/20 rule is a simple monthly budgeting plan.It tells you how much money to spend each month on savings and living expenses. A good rule of thumb is to split your monthly after-tax income into three spending categories: 50% for needs, 30% for necessities, and 20% for expenses. Save money or pay it back.

You can use your money more efficiently by balancing your expenses on these big expenses. With only three main categories to track, you can save yourself the time and hassle of diving into the details every time you use them.

However, the 50/30/20 rule should only be used as a general rule. The percentage for each category varies, based on your personal financial situation, local cost of living, inflation, and many other factors.Savings Account

Saving is one of the most important aspects of financial literacy for beginners. Defining your savings goals gives you a clear picture of how much money you need to put aside. However, it might be a little challenging looking at all the bills and payments. But there are multiple ways of saving your money, one of which is by opening a savings account.

Opening a savings account is one of the most safe and secure methods of meeting your idea of saving money. Saving money in a savings account won’t just promise you security but might also pay you interest and even offer insurance.

Other than the things mentioned above, carrying an ATM is way easier and more convenient than carrying a wallet. Moreover, billing becomes easier.

Alternatives to savings account:

1. Checking accounts: these accounts are designed for everyday use. An individual can withdraw money whenever they want. The transaction can be doen via ATMs, ACH, or bank tellers and can make payments through debit cars or a check. You get to withdraw unlimited amount of money at a low interest rate.

2. Money Market account: This type of account restricsts withdrawl to six per month. It has much higher interest rate than savings account. The maintainence and opening of an MMA requires a minimum balance.

3. Certificate of deposits: It is one of the best mehtods to earn higher interest rates. In this case you are required to keep your money for a fixed term. If you plan for a withdrawal before the terms ends then you must be charged a penalty fee for the same.

4. High-yield savings account: These are quite similar to the savings account but with higher interest rates and no monthly fee. Balance requierments are generally low and sometimes not required at all.

Credit Score

Credit score is an important aspect of financial literacy for beginners. Paying your bills on time makes you more responsible and the lender builds trust in you which can help you in the future in acquiring loans. In the U.S. the credit score is measured in a three-digit number varying between 300-800.

A high score indicates that the person is at low financial risk and pays his loan on time, while a person with a low score indicates that he is at high financial risk and cannot pay the loan fee on time. You must know about your credit report, which summarizes your financial health. This way you can detect errors or fraud and take legal actions to recover the amount of money lost. Tracking your spending and improving your credit score can be easily done with the credit report.

Consumer Financial Protection Bureau (CFPB) advises that your credit utilization ratio must be equal to or less than 30%. The better your credit, the more likely you will get good scores and better interest rates on credit cards and other loans.

Ranges of credit score:

Excellent: 800–850

Very Good: 740–799

Good: 670–739

Fair: 580–669

Poor: 300–579Calculation of credit score:

- Payment history: It keeps an account of the late payment of bills. The number of late payments and for how long the bill was not paid is mentioned in this.

- Length of credit history: Longer credit histories are considered risk-free.

- Amounts owed: It is basically the credit utilization, i.e., the amount of credit you have used compared to the available credit.

- Credit mix: It includes instalment credit, such as car loans or mortgage loans, and revolving credit, such as credit cards. The variety of your credit types portrays an image to the lender such that you can handle a variety of credit types.

- New credits: Lenders view new credit as a potential sign that you will need adequate credit. Applying for too many loans recently can negatively impact your credit score.

Repayment of your debts

You have to borrow money through loans at some point in your journey, say for school or to buy/renovate a house. However, what is important is that you live a debt-free life. Identifying loans that charge higher interest and should be paid off first. This way you can reduce the interest you pay in the long run. Then you can make repayment of loans based on the interest rates that they charge. You can also follow this procedure the other way around. Make repayments for smaller loans than the larger ones.

Key steps for payment of your debts:

1. Look for the amount of payments that you need to make.

2. Decide the debt repayment plan you want to follow.

3. Calculate your baseline budget.

4. Allocate your money.

5. Save on interest.

6. Stay accountable.

7. Celebrate your progress.Expecting and managing risks

We never know what will we be served next. For example, the year covid pandemic hit the entire world, most of the people were facing a financial crisis. Such situations call for ensuring financial literacy for beginners.

Many people aren’t aware of their finances and are not prepared for the risks that they might face in the future. Experts recommend having a reserve of at least 3-6 months of living expenses for use in case of emergency. It is better to be prepared early than late. For instance, if you lose your job or you are not earning whatever the reason may be, you can avoid these small financial risks because you will have money saved in your accounts which can be used to pay your daily bills till the time you start generating an income.

Cut down on your expenses

When you decide on saving or investing, you do need an extra amount of money in your pocket. This can be either by increasing your income or by cutting down your expenditures.

Look out for your monthly expenditures and areas where you can stop spending. Start buying things that are most important on the list. You can put a hold on things that are not that essential and buy them the next month instead.

Practicing this every month gives a clear picture of your spending. You can detect the areas where you spend the most, cut down on, and save more.

Secure your future

Once you get a command over your money it is always a good decision to start thinking about generating more money and saving for future use.

You can educate yourself about different investment opportunities and determine the investment return rate. This way you can generate income even after you retire. However, you must keep in mind and make a list of all the expenses that you might bear after retiring. Based on that you must make a final decision.

Additionally, investments are not always risk-free. Different investment plans offer different levels of risk and return.

Things to consider before making investing decisions:

1. Draw a personal financial roadmap.

2. Evaluate your comfort zone in taking on risk.

3. Consider an appropriate mix of investments.

4. Be careful if investing heavily in shares of employer’s stock or any individual stock.

5. Create and maintain an emergency fund.

6. Pay off high interest credit card debt.

7. Consider rebalancing portfolio occasionally.

8. Avoid circumstances that can lead to fraud.Benefits of financial literacy for beginners

Becoming financially literate not only increases your financial stability but also improves your standard of living.

Below are some benefits of financial literacy for beginners:

- You can manage your money effectively.

- You learn about your credit score through your credit score report and manage your debts as well.

- You learn how to save money.

- You avoid unnecessary expenditures.

- Your financial decision-making improves.

- When you are financially stable you avoid stress and anxiety.

- You end up making a structured budget for yourself.

- You can increase your income through various ways.

- You are aware of the risks that might be attracted when you invest or borrow loans.

- You are more aware of what is going on around the world.

- You can set short-term or long-term financial goals.

- You feel more powered.

- You feel more self-reliant.

Key takeaways of financial literacy for beginners

- Master the five foundations of financial literacy which include, budgeting, saving, investing, credit score, debt management, and risk management.

- Follow the four rules of financial literacy: live within your means, plan for the future, keep yourself informed, and appreciate time.

- Realize the importance of financial literacy in achieving financial independence, reducing stress improving health.

Conclusion

Improving financial literacy is an important part of managing money and achieving financial goals. There are some simple steps you can take to increase your financial knowledge and apply what you learn with confidence. Financial literacy for beginners also becomes more important these days because of the outgrowing technology leading to various risks and fraud.

For more knowledge read: https://moneyjax.com/financial-education/

Frequently Asked Questions

Do I need specific mathematical skills to be financially literate?

The answer is no. Being financially literate does not mean you need to carry out complex calculations. It means to understand and apply certain basic concepts in your day-to-day life.

Is it too late for me to become financially literate?

No, it is never too late to acknowledge the importance of financial literacy for a beginner. You can start whenever you want from the basics and eventually continue to build your knowledge in the field.

Isn’t financial literacy only important for people who make a lot of money?

Financially literacy for beginners is really important. It is not just for the people earning in great numbers, but for everyone. Understanding the importance of your money, and where you spend it will help you make the most from it and help you avoid unnecessary debt.

Is it enough to just put my money in a savings account?

Financial literacy is important for beginners which is why it helps you understand that saving is not the only thing that one must be doing. You can grow your wealth in several other ways besides just saving. Like investing is a great option to go ahead with.

Why is financial literacy important?

Overall, financial literacy is about empowering yourself with the knowledge and skills to make smart decisions with your money. It is a lifelong journey, but one that is well worth taking.

How can I improve financial literacy?

Financial literacy for beginners requires them first to educate themselves about personal finance. Learn different financial management tools, opt for a financial advisor, teachers, and professors and apply basic skills to your day-to-day life.

What are the key components of financial literacy?

Financial literacy includes some basic principles, which are budgeting, investing, saving, credit score, clearing your debts, and management of risks.

Why is saving money for the future important?

You never know what the situation might be in future. It is therefore important to keep an emergency fund for situations when you require extra money; or sometimes in a sudden event your income stops, this saving of yours can then help you run your daily errands smoothly.

How to get out of debt?

List out your debt details

Adjust your budget

Cut down interest by making biweekly payments

Refinance your debt

Submit more than the minimum payment

What does poor financial literacy lead to?

Poor knowledge of finances leads to higher debt and bankruptcy. Not only individuals but the whole financial system gets affected which is why financial literacy for beginners is important.