In the sprawling landscape of financial markets, one niche segment holds a unique role in funding local development and community projects: the municipal bond market. Also known as “munis,” municipal bonds are debt instruments issued by state and local governments to finance essential public ventures such as schools, hospitals, infrastructure, and more. In this extensive guide, we’ll unravel the intricacies of the municipal bond market, providing a deep dive into its workings, significance, risks, and rewards.

Municipal bonds, often termed “munis,” are debt securities issued by local governments to fund public projects. Investors purchase these bonds, essentially lending money to municipalities, in exchange for periodic interest payments and return of principal at maturity. Municipal bonds are attractive to investors due to potential tax advantages, as interest income is often exempt from federal and sometimes state taxes. These instruments play a crucial role in financing community initiatives such as schools, infrastructure, and utilities. Despite offering lower yields compared to corporate bonds, municipal bonds are considered relatively low-risk investments, backed by the taxing power of the issuing municipality.

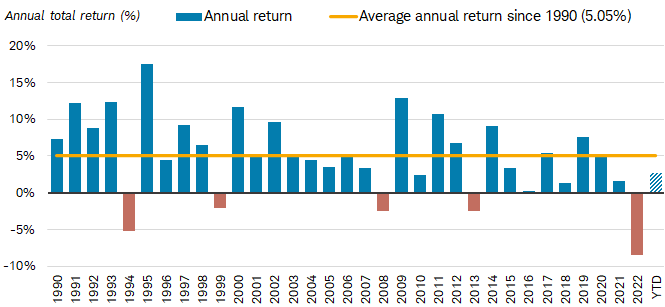

The adage “the more things change, the more they stay the same” accurately summarizes the municipal bond market today. Despite a dismal 2022 total return forecast and an eventful first half of the year dominated by concerns about banking instability and the debt-ceiling drama, the outlook for the muni market remains largely unchanged. We are bullish on the muni market for the rest of the year, owing to the combination of attractive yields and strong credit conditions.

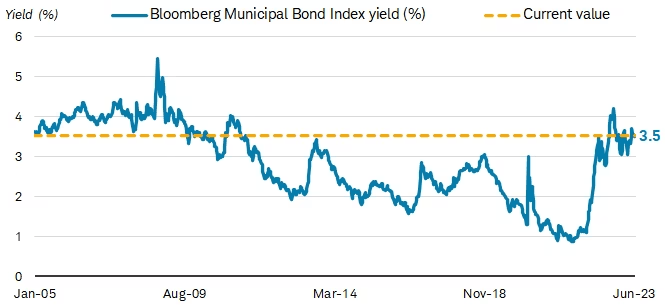

Only two years ago, the yield on a broad index of municipal bonds was 1%, near the lowest level in the index’s history. A $1 million portfolio would be required to generate $10,000 in interest income. An investor would need a large investment to generate a small amount of income. That is no longer the case. Yields have risen above 3.5% since the trough in July 2021. An investor would now need a portfolio worth around $280,000 to earn same $10,000 in interest income. While it is still a significant sum, it is far less than $1 million.

The yield for a broad index of municipal bonds is close to the highest point in years

Municipal bonds are issued by cities, states, and local governments, and the majority pay interest income that is tax-free at federal and possibly state levels. While 3.5% isn’t as high as the yield offered by other fixed-income investments, municipal bonds are one of the few investment options that are frequently exempt from federal and possibly state income taxes (if the issuer is located in a state where the issuer is located), so after adjusting for this, they are attractive relative to alternatives.

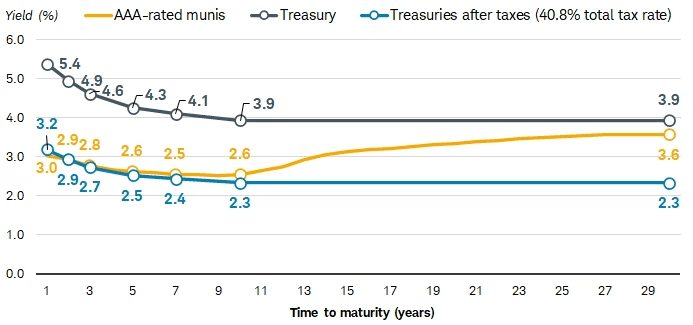

We like the intermediate part of the yield curve

Clients frequently ask us, “Why should I invest in intermediate-term bonds if I can get the same or even a higher yield with shorter-term bonds?” The answer is simple: “reinvestment risk.” By purchasing some longer-term bonds, investors lock in those yields rather than remaining in short-term bonds and being more vulnerable to changes in interest rates. A one-year general obligation AAA-rated muni, for example, yields around 3%, while a similarly rated five-year muni yields 2.6%.2 When the one-year muni matures in a year, an investor will have the option of reinvesting at a lower rate, whereas the investor in the five-year muni has locked in a yield of 2.6% over the life of the bond.

Investors should consider some intermediate-term bonds even though short-term ones can yield more

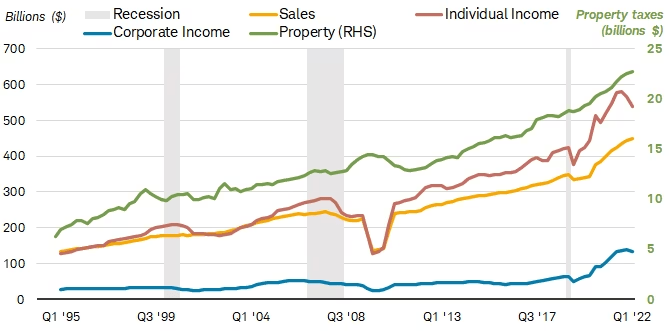

We don’t have major concerns about credit quality for most muni issuers

There are signs that the strength in credit quality for state and local governments is beginning to wane, but this isn’t a major risk in our opinion. State tax revenues are nearing record highs as a result of fiscal assistance provided in response to the COVID-19 pandemic, as well as the economy’s continued strength. This has allowed many states to build up their reserve levels to record levels, putting them in a strong financial position to weather a decline in revenues.

Tax revenues have surged to record levels

Although credit quality is high, we believe that Muni’s credit quality has peaked. If the economy continues to grow below trend, the rate of growth in state and local government tax revenues should slow as well. The slowing of tax revenues is unlikely to increase defaults or downgrades, but it will slow the rate of upgrades.

Tax revenue is already slowing in states that rely more on revenue sources that are more closely linked to economic growth. Corporate and income taxes, for example, account for more than 70% of tax revenue in both New York and California. New York’s tax revenues are down 3.3%, while California’s are down 9.5%.3 Again, we don’t believe this poses a significant risk because most states are already financially secure.

We suggest sticking with investment-grade issuers, but take risks cautiously

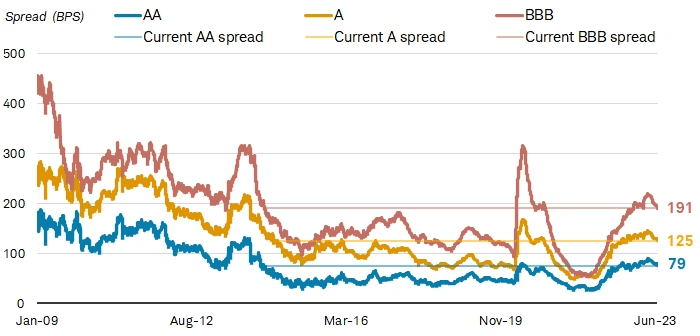

Although we have no major concerns about credit quality, we do not believe that lower-rated bonds are currently appealing. Lower-rated bonds are generally more appealing when credit risks are low, but we believe that investors will be better served by focusing on higher-rated investment-grade issuers, such as those rated AA/Aa or higher. We believe that investors with a higher risk tolerance could consider some bonds in the A/A category, but we would advise caution with BBB/Baa-rated issuers. If you have risk tolerance, we believe they should account for only a small portion of your overall muni’s portfolio.

One reason we recommend staying higher in credit quality is that spreads (the additional yield for taking on credit risk) have increased, so investors don’t need to target the lowest rungs of investment grade to get higher yields. In other words, at the start of 2022, the average BBB-rated bond only yielded about 1.5%, or about 0.5% more than the average AAA-rated muni.4 Today, the average A-rated muni yields about 3.9%, which is about 1.3% higher than the average AAA-rated muni. In other words, investors are now better compensated for taking on less credit risk than they were at the start of the year. Spreads have recently retreated, but we believe they remain attractive in comparison to their longer-term average.

Conclusion

Many parts of the market had an eventful first half of the year, but munis have not. That’s a welcome relief because it shows that municipal bonds are doing what they’re supposed to do: providing tax-advantaged income with little volatility. We anticipate more of the same for the muni market in the future. We prefer to stick with higher-rated issuers and focus on the intermediate part of the yield curve.

The municipal bond market serves as a bridge between local development and financial opportunities. By enabling governments to secure funds for projects that enhance the lives of citizens, while also offering investors an avenue for income and potential tax benefits, municipal bonds embody the symbiotic relationship between community progress and financial investment. Understanding the intricate dynamics of the municipal bond market empowers both investors and governments to make prudent choices that contribute to the betterment of society.

Frequently Asked Questions:

What are municipal bonds?

Municipal bonds, often referred to as “munis,” are debt securities issued by state and local governments or their agencies to raise funds for various public projects, such as infrastructure, schools, and hospitals.

How are municipal bonds issued?

The issuance of municipal bonds involves planning, approval from relevant authorities, underwriting by investment banks, setting bond terms (interest rate, maturity, etc.), marketing to investors, and ultimately closing the bond offering.

How does the COVID-19 pandemic impact the municipal bond market?

The pandemic has affected the municipal bond market by causing revenue declines for governments due to lockdowns and economic slowdown. However, fiscal stimulus measures and increased bond issuance to support recovery efforts have played a role in stabilizing the market.

What risks are associated with municipal bonds?

While municipal bonds are generally considered lower risk, there are risks to be aware of, including interest rate risk, credit risk (default risk), call risk, and market risk. Market conditions and the issuer’s financial health can impact the value and performance of municipal bonds.

What are the benefits of investing in municipal bonds?

Investing in municipal bonds offers tax advantages, stable income, and portfolio diversification. Tax advantages include potential exemption from federal income tax and, in some cases, state and local taxes.