When choosing a place to live in, it becomes a tough choice and people end up in confusion about whether buying is a better option or renting as it is a huge part of everybody’s life.

Now, the question arises whether to buy or rent a home. It is a never-ending debate that has been argued upon for several ages. However, buying a home of your own can serve your long-term goal. But it ultimately depends upon an individual, your financial status, and many more factors.

A place like San Francisco in the United States costs pretty high when it comes to living. So, thinking twice about buying or renting or rent-to-own home is quite obvious. Renting a home comes with fewer responsibilities while owning a home burdens you a bit. And also renting is a bit cheaper option as it incorporates less cost overall if we look at it like that. However, in both cases, you will find a good place to live in.

To furthermore decide upon between renting and buying one must consider the Price-to-rent ratio. This ratio gives an analysis of home prices to that of annual rent. This will make your decision easier about renting or buying a property.

If you are not sure whether to rent or buy a house, the rent-to-own home contract permits you enough time and space to decide whether you want to rent or buy a property.

What are Rent-to-Own homes?

Rent-to-Own home generally implies renting a property for a fixed period with an option for you to purchase it before the lease runs out. to purchase a new house you will have your pockets full to finance your purchase without which homebuying could be a little tough.

The agreement consists of two parts:

1. Standard lease agreement

2. Option to buy

Such homes require a monthly payment, which leaves you with an option to buy the property as well. This procedure is a bit different than the usual buying process. In case, you do not have a cash flow for the payment to purchase a home you can improve your credit score and buy a property through this process.

Eligibility for rent-to-own home

- Your household earns £60,000 a year or less. A household can be one person, or you and a partner, or you and a friend.

- You are a first-time buyer, or you used to own a home but can’t afford to buy one on the open market now.

- You have a good credit history.

- Working and planning to buy a home in the future.

- Be a first-time buyer and not yet own a home.

- No some circumstances will prevent you from buying a home for the next 5 years.

- Make relevant affordability and credit checks.

- Meet ‘tenancy rights’ criteria.

- Provide good certificates from existing landlords (if applicable).

- I can pay one month’s rent and pay in advance of deposit.

However, it depends upon the housing association who offers the property to you. Existing housing association tenants and council tenants, people who fit with local priorities, as well as first-time buyers are usually prioritized. Rest you can check it from the government’s rent-to-own home website anytime for any queries related to this.

In case you are eligible you need to contact your local housing associations to start your research. And if you do not qualify you can always opt for other schemes that will help you in buying your first home. there is always another option available.

The important thing to remember is that renting is not for people who can’t afford to buy, but for people who can’t get a deposit for renting.

You will need a good credit history to prove that you can afford the mortgage and future mortgage payments.

When you’re ready to start your journey as a homeowner but don’t have a deposit for shared ownership, renting is the best first step.

How does a rent-to-own home work?

With a rent-to-own home, you rent a home at the market price. The contract that you sign is valid for 5 years. After the end of the second year and the concluding time-lapse of your 5 year contract, you can further proceed to buy the property. When you apply to buy your home, you will receive 25% of the rent you have paid back. in addition to that 50% of any increase in the property value since you moved in is also received. The money can be used as a deposit to buy the home in the future.

How to apply?

- Register with help to buy: They will assess your application and see if you are eligible or not. Once you are confirmed as eligible then they will add you to their main databases.

- Complete the details and forward your application form to the housing associations that are offering you the property.

- Credit reference check: You need to check whether you are financially stable to go for the scheme. The customer’s details are forwarded for a credit reference check once they approve it.

- After the credit reference check is passed an offer letter is sent to you for your desired property. Multiple applications for the same property might be received in that case the customer is chosen based on one’s need for a home.

- Further, you can view the property and lock the deal accordingly.

- If you are sure you want to proceed further with it you need to finish the paperwork and after that, you will be assigned the tenancy.

- After all the formalities you need to pay a deposit for 5 weeks. This particular amount is added to the Deposit protection scheme.

- Besides the deposit, you need to pay the rent for the remainder of the month from the date of your tenancy sign-up and also the month’s rent in advance.

- After the deposition, you can fix a date and decide when to move in.

In this way, you can sign up for a rent-to-own home and have keys to your happy place!

How to find a rent-to-own home?

- Consider being proactive on the local website for rent-to-own homes. Browse for various choices and properties around you. However, it is not that easy for sure like in places like London etc. you need to contact the house associations directly.

- Another option is to find a property that you like, ring the contact number mentioned in the advertisement, and check your eligibility for the same.

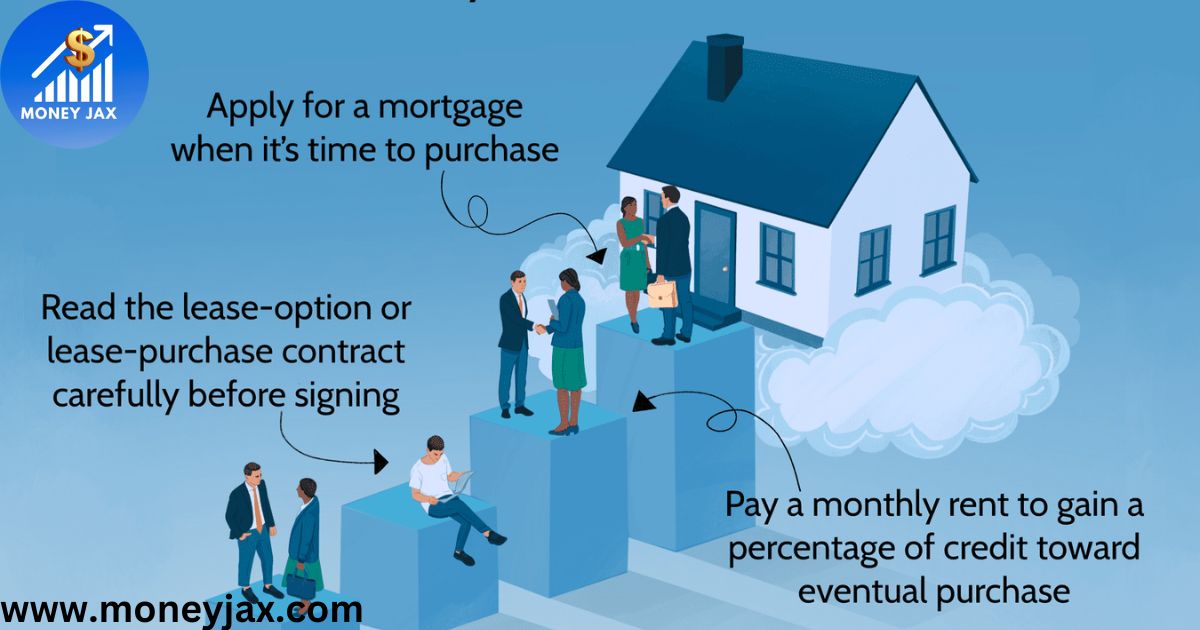

Steps to follow

Purchase Price Determination

The rent-to-own home must mention the time and procedure of the price fixed for the property. The prices are decided according to the marketing trends. Many people fix the price on the day of signing of the agreement while some decide for the price after the lease-duration is over. In both cases, the price fixed while signing the rent-to-own home contract is more than the market value while the latter is associated with the current market value.

Comparing rent to the principal amount

The rent is to be paid every month throughout the lease term. If we calculate it deeply the rent paid is higher than the credit that is received at the end. Although renting may be higher you know what you are getting in return

Maintenance of the property

Rent-to-own home maintenance depends upon the conditions set as per the agreement. Unlike renting a home, the rent-to-own home makes you responsible for the bearing of cost for the repairs and other things. Generally, most of the rent-to-own home agreements state the landlord is responsible for carrying out all the expenditures like taxes, repairs, insurance etc. Please read the contract carefully. However, the landlords anyhow cover the cost for all these later on. But one must make sure about everything mentioned in the contract.

Purchasing the property

Now, at last, when you are aware of the contract and everything about the house you must decide whether you want to buy a house or move out of it at the end of the lease term. This depends upon the kind of contract you have signed up for. If you have a lease-option contract and want to proceed further with buying the house you may Buy the property with any financial tool you prefer to pay the amount to the seller. In case you do not want to purchase the property you may vacant the house as the lease term ends.

Now, if you have signed the lease-purchase contract under a rent-to-own home agreement you are bound to purchase the particular property as soon as the lease expires. If you are unable to pay the amount to the seller it might become a little problematic for you, unlike a legal-option contract which leaves the choice of purchasing the property up to you. That is why the legal-option contract is much more widely preferred over the legal-purchase contract. Because it provides flexibility to the people.

Key points you must know about such procurement

- In this agreement, you need to pay an amount of money to the seller known as the option fee which is negotiable and permits you to buy the property after some time in the future. It is approximately 1%-5% of the principal amount of the house. The option fee is to be paid only once. and it is non-refundable. The option fee is also called option money and option consideration.

- The agreement is also classified as a Lease-option and Lease-Purchase contract. The lease option gives you the right to purchase the property at the end of the lease period while lease-purchase leaves you with no option but to buy the property. when you start thinking of a rent-to-own agreement make sure about the contract you are signing as you may end up with various legal obligations.

How much do you save from a rent-to-own home?

Rent to Buy is outlined for individuals who are gaining sufficient to qualify for buying a domestic through Shared Ownership,

but have not however been able to spare sufficient for a deposit. You’ll be able to lease a Peabody domestic whereas sparing for a store amid the 2 years you’re leasing with us. See how much investment funds you’ll make to contribute to your deposit.

Cost of your home - £380,000

Reservation fee - £99

Five weeks' deposit - £1,270

Market value rent (monthly) - £1,400

Monthly rent you will actually pay (-20%) - £1,100A 20% discount on your rent means you can build up savings of £7,200 in just two years.

Who should opt for such buying options?

Everyone has a dream home in mind for themselves but sometimes we are not all ready financially, to support this dream of ours. A Rent-to-Own home is a good choice for improving your credit score and setting a long-term goal of purchasing your own house.

Rent-to-own home agreements are usually granted to people who can not apply for conforming loans. Other than these people such candidates are also there who either can not get a mortgage or cannot get non-conforming loans.

The home financing industry gets into trouble after the consumers as the prices of homes surge resulting in a crossing of conforming loan limits due to which people are pushed into jumbo loans. The down payment requirement is strictly risen from 20% to 40% due to which financially capable people also find troubling financing in this market.

By opting for the rent-to-own agreement the consumer also sets an equity for himself in case he does not want to buy the property. The rent and the purchase price that you pay to the seller are locked in for up to 5 years.

However, renting and owning are two different concepts. With homeowning, comes various responsibilities, obligations and benefits. On the one hand, renting offers flexibility, fewer responsibilities and someone to look after the repairs. In the end, both ways you will be provided a place to live in and a rent-to-own home agreement will always leave you with a choice of buying the property.

Signing the agreement

This whole procedure will land you and the seller with some legal obligations that you must be aware of. Make sure while signing the agreement whether it is a lease-purchase or a lease-option contract. Hiring an official for the same must be of great help to you. Make sure and read the terms and conditions carefully. Also, be sure about the steps mentioned at the start of this article before buying any property. Conduct proper research about the seller, the property and the locality.

What if you change your mind within two years after signing the agreement?

A lot can happen in two years and one can understand the fact that people may change their mind in between the time of the signing of the agreement. If the home you rented is no longer available for purchase for any reason, you have a few options:

- You may consider purchasing a new Peabody home by sharing. Become a member and get 5% cashback.

- You may consider purchasing other Peabody sale products without refund support.

- You can choose to move out of the house.

Rent-to-own home advantages

- If you have a low credit score or are financially not that well to secure a mortgage or make a down payment by signing up for the agreement you can build equity for yourself and can also purchase the same property in the future if he changes his mind. In this way, you can benefit from the agreement even if you are running low on your savings.

- What makes a rent-to-own home agreement different from normal buying is that it is a two-way approach where a portion or entire rent that you pay to your landlord builds equity for you over time. And in such cases, you do not have to even secure a mortgage or make a down payment to do so.

- Rent-to-own home is one hell of a legal engagement and one must conduct proper research or hire a specialist or qualified real estate to guide and pave the way to a secure and legally right home building. One must be aware of the contracts that he or she is signing and the rights that come along with it.

Rent-to-own home disadvantages

- If the house price increases while you’re renting, it may be more than you can afford. The longer the lease term, the more risk you face. Rent to Own in Wales will give you 50% of the increase back to help you with your deposit.

- Options are limited.

- You must join the program’s waiting list.

Why you should go for it

If you are eligible for the rent-to-own home scheme then the choice is completely up to you. It depends on the property, the offer from the housing association and if you want to take advantage of the reduced rent to save up for a deposit. The offer varies from association to association. It is important to read the contract carefully to keep account of what you are being offered so that you can look for the benefits you can procure from it.

If you plan to move forward, we recommend cutting costs when renting as well to make sure you save enough money. If you’re planning to sign for and eventually buy the property, speak to an independent mortgage advisor first and get an estimate of how much your monthly repayments will cost. You should ask your lender if they are willing to lend money as a personal loan against the property. Remember that the cost of buying a home should also be taken into consideration.

Other ways to buy a property

Numerous government schemes permit you to buy a house for yourself; some of these include the below-mentioned ones.

Shared ownership

Under this scheme, you are allowed to own a part of the house and rent the rest as long as you meet specific eligibility criteria.

Guarantor mortgages

In case you do not have a deposit this scheme will help you get a mortgage. A Guarantor mortgage is someone whom you know and who will be responsible for the repayment of the mortgages if you cannot pay for them, whatever the reason is. The Guarantor can be anyone; be it your parents, relatives or a close friend.

https://youtu.be/XRQgCU_ZnJM?si=sZPZZdo0-LMYzzcl

Video Credit: Iman GadzhiConclusion:

Rent-to-own homes can be a viable option for those facing obstacles in traditional home buying, offering a pathway to homeownership. However, due diligence, careful consideration of the terms, and a realistic assessment of personal finances are essential. Individuals should weigh the pros and cons, considering their long-term goals and financial stability, before entering into a rent-to-own arrangement. Consulting with a real estate professional and legal advice can also be beneficial in navigating the complexities of such agreements.

For other references:https://moneyjax.com/real-estate-finance/Frequently Asked Questions

What Are Rent-to-Own-Homes?

Homes include a clause in the rental agreement that provides you the option of buying a home or an obligation to buy a home after a certain period.

How can I buy a house with no money down?

There are several ways in which you can arrange for funds to pay the minimum down payment for a home loan like asking your friends and family, using the money you have invested, liquidating some assets, etc.

Does one need good credit for a rent-to-own home?

Keep in mind that depending on the type of rent-to-own contract, a renter may be obligated to buy the home even if they can’t afford it. For someone with a lease-purchase contract, having good credit at the time of purchase is imperative.

How does a rent-to-own home work?

A rent-to-own home, also known as a lease-to-own or lease-option home, works as a hybrid between renting and buying.

Is a rent-to-own home better than shared ownership?

The rent-to-own home provides you flexibility and an opportunity to shift from renting to buying a home. Therefore, it is a better option to go with.

Can I rent a home from my landlord?

Rent-to-own home schemes are officially run by housing associations.

How long can I live in a rent-to-own home?

The initial tenancy is for 18 months. After that, it will continue on a rolling basis until the five-year mark. By signing the rent-to-own home contract one has the option to either leave the rented house or buy the property at the end of the duration.

What are the benefits of rent-to-own homes?

Rent-to-own home allows you to live in a newly built property at the cost of a monthly rent which is equal to about 80% of the property’s rental price. A lower monthly fee is designed to help you save money for future expenditures.

What is the duration of the rent-to-own home agreement?

Duration of agreement: The time for which the rent-to-own agreement stands legal. If the buyer fails to make payments, as prescribed in the agreement, the owner can claim termination. The buyer loses all rent credits, and related fees paid even if the option period expires.

Why is a rent-to-own home not the best option?

If property prices fall in the real estate market, you may be paying more for the property than it is worth. This will put you in a bad financial situation.