In the fast-paced world of technology and finance, few companies have captured the imagination of both consumers and investors quite like Apple Inc. (AAPL) Stock. With its groundbreaking products, innovative designs, and a commitment to pushing the boundaries of technological advancement, Apple Inc. has become a global powerhouse that has significantly impacted our lives and the stock market. In this article, we will delve into the history, growth, and investment potential of Apple Inc. stock, exploring its journey from a garage startup to a trillion-dollar empire.

The Apple Inc. Evolution: From Garage to Global Dominance

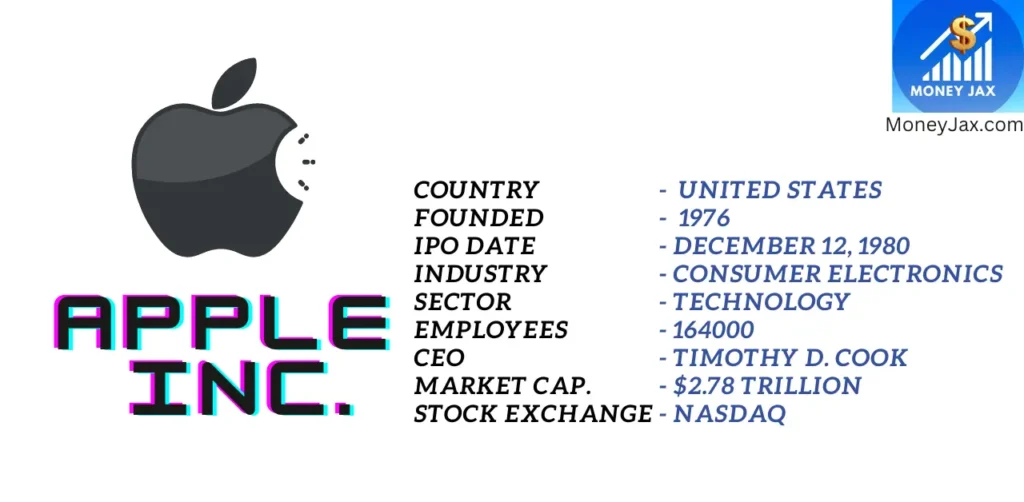

Apple Inc. was born in a humble garage in Cupertino, California, in 1976. Co-founders Steve Jobs, Steve Wozniak, and Ronald Wayne set out to revolutionize the personal computer industry. Their vision culminated in the creation of the Apple I, a simple yet groundbreaking computer that laid the foundation for Apple’s future success.

Operating out of a garage in Cupertino, California, the trio set out to revolutionize the personal computing industry. Their first product, the Apple I computer, was a modest success, but it was the launch of the Apple II in 1977 that propelled the company into the limelight. The Apple II was an unprecedented success, cementing Apple’s position as a leading innovator in the tech world.

Throughout the 1980s and 1990s, Apple faced its share of challenges, including leadership changes and market struggles. However, the return of Steve Jobs in 1997 marked a turning point for the company. Jobs introduced a series of game-changing products, including the iMac, iPod, iPhone, and iPad, which revolutionized the way we communicate, consume media, and interact with technology. Over the years, Apple’s relentless focus on innovation led to a series of game-changing products, including the Macintosh, iPod, iPhone, iPad, and Apple Watch. These devices not only transformed entire industries but also reshaped the way we communicate, work, and entertain ourselves.

Apple Inc. (AAPL) stock has consistently been a beacon of innovation and profitability in the tech industry. Investors flock to AAPL, drawn by its groundbreaking products, robust financial performance, and global brand loyalty. With each new iPhone release, the stock experiences surges, reflecting consumer excitement and confidence. Apple’s ecosystem, comprising devices, services, and software, generates a reliable revenue stream, contributing to its market resilience. Despite occasional challenges and market fluctuations, AAPL remains a staple in investment portfolios, reflecting its long-term stability. As Apple Inc. continues to redefine technology, its stock symbolizes a symbol of growth and endurance in the ever-evolving market landscape.

Apple Inc. (AAPL): Transforming Tomorrow, Today

At the intersection of technology and innovation stands a company that has woven itself into the fabric of our daily lives—Apple Inc. With a legacy as captivating as the products it brings to the world, Apple has earned its place as a symbol of creativity, progress, and design excellence.

A Journey of Innovation

Imagine a time when computers filled entire rooms. Then, in 1976, Apple emerged with a vision to make computers personal and accessible. Founded by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple embarked on a journey that would revolutionize technology forever.

In 1984, Apple introduced the Macintosh, a groundbreaking computer with a user-friendly graphical interface. It was a game-changer, setting the stage for the brand’s commitment to simplicity and elegance.

The Iconic iPhone Era

Fast forward to 2007, and Apple unleashed the iPhone—a device that would redefine communication, entertainment, and even how we capture memories. The iPhone wasn’t just a phone; it was a pocket-sized computer, camera, and music player rolled into one. Its touch screen changed the way we interacted with technology, making it intuitive for everyone.

More than Gadgets: The Apple Ecosystem

Beyond devices, Apple crafted an ecosystem that seamlessly connects our lives. Your iPhone talks to your iPad, Mac, Apple Watch, and even your AirPods. This synergy allows you to start a task on one device and effortlessly continue on another. It’s this integration that forms the heart of the “Apple experience,” creating convenience and a sense of unity among its products.

Innovation Beyond Limits

Apple’s innovation didn’t stop at iPhones. The iPad introduced a new way to consume media and work on the go, while the Apple Watch became a health and fitness companion, inspiring healthier lifestyles. Apple’s commitment to the environment also shines through with initiatives like recycling old devices to create new ones and powering operations with renewable energy.

Investing in Tomorrow

For those who follow the stock market, Apple’s stock symbol (AAPL) has become a familiar sight. Apple’s stock performance has been nothing short of remarkable, reflecting the company’s ability to adapt, evolve, and capture the imagination of consumers worldwide.

While Apple faces challenges like any other company, such as competition and changing consumer preferences, it continues to innovate. The introduction of services like Apple Music, iCloud, and the App Store has diversified its revenue streams, making it not just a product company, but also a service provider.

What Does the Future Hold?

As we look ahead, the future of Apple is as exciting as its past. Rumours swirl about potential game-changers like augmented reality glasses and advancements in artificial intelligence. Apple’s commitment to user privacy and security remains unwavering, a critical factor in a digitally connected world.

Apple’s impact stretches far beyond technology. It’s about empowering creativity, enabling connections, and enriching lives. From the sleek lines of its products to the intuitive interfaces they boast, Apple has a knack for making technology feel personal and inviting.

So, whether you’re texting on your iPhone, listening to your favorite tunes on Air Pods, or editing photos on your Mac, remember that behind these innovations is a company that continues to shape the world we live in—Apple Inc., where imagination knows no bounds.

The Stock’s Phenomenal Growth

The journey of Apple Inc. stock has been nothing short of remarkable. From its initial public offering (IPO) in 1980, where the stock was priced at $22 per share, to becoming the first trillion-dollar company in terms of market capitalization in 2018, Apple’s stock performance has captured the attention of investors around the world.

One of the key drivers of Apple’s stock growth has been its consistent ability to innovate and create products that resonate with consumers. The introduction of the iPod in 2001 marked Apple’s entry into the music industry, while the iPhone’s launch in 2007 redefined the smartphone market. These breakthroughs not only drove revenue and profits but also contributed significantly to the appreciation of Apple’s stock price.

Dividends and Share Buybacks

In addition to its product innovation, Apple’s approach to returning value to shareholders has also played a pivotal role in shaping its stock’s performance. The company initiated a dividend program in 2012, marking a significant shift in its financial strategy. This move was followed by a series of robust dividend increases and share buyback programs.

Dividends provide a steady stream of income for investors, while share buybacks reduce the number of outstanding shares, effectively boosting the company’s earnings per share (EPS) and potentially driving up the stock price. Apple’s commitment to returning capital to shareholders has not only made its stock more attractive to income-focused investors but has also signaled a level of financial stability and confidence in the company’s future prospects.

Challenges and Opportunities

While Apple Inc. has enjoyed impressive success over the years, it has not been immune to challenges. The tech industry is fiercely competitive, and Apple faces pressure to continually innovate and anticipate consumer trends. Additionally, geopolitical factors, supply chain disruptions, and changing consumer preferences can impact the company’s performance.

However, with challenges come opportunities. Apple’s expansion into services such as Apple Music, Apple TV+, Apple Pay, and iCloud has diversified its revenue streams and reduced its dependence on hardware sales. These services capitalize on the company’s massive user base and ecosystem, offering a potentially recurring and predictable revenue stream.

Moreover, Apple’s foray into emerging technologies, such as augmented reality (AR) and autonomous vehicles, could open new avenues for growth and further solidify its position as a technological pioneer.

The Investment Landscape

For investors considering Apple Inc. stock, several factors warrant careful consideration. First, the company’s financial health and stability provide a solid foundation for long-term investment. Apple boasts a robust balance sheet with substantial cash reserves, allowing it to weather economic downturns and invest in future growth opportunities.

Second, the company’s valuation should be assessed relative to its peers and historical metrics. While Apple’s Inc. stock price has experienced significant growth, investors should ensure that the stock is trading at a reasonable valuation that aligns with the company’s fundamentals and growth prospects.

Third, staying attuned to industry trends and technological developments is crucial. The tech landscape evolves rapidly, and Apple’s ability to stay ahead of the curve will play a crucial role in its continued success.

Key Drivers of AAPL Stock

Several key factors have contributed to Apple Inc.’s stock becoming a darling of investors:

- Innovative Product Lineup: Apple’s knack for introducing game-changing products has driven consumer demand and investor confidence. From the revolutionary touch interface of the iPhone to the sleek design of the MacBook, each new release has propelled the company’s stock to new heights.

- Ecosystem and Brand Loyalty: The Apple Inc. ecosystem has played a pivotal role in maintaining brand loyalty and customer retention. The seamless integration between Apple devices, software, and services fosters customer stickiness, making it challenging for users to switch to competitors’ products.

- Robust Financial Performance: Consistently impressive financial results have bolstered investor sentiment. Apple’s strong revenue streams, healthy profit margins, and prudent financial management have contributed to the company’s ability to weather economic uncertainties.

- Global Reach: Apple’s Inc. presence is truly global, allowing it to tap into diverse markets and demographics. The company’s strategic expansion into emerging markets has provided a solid growth trajectory for its stock.

Conclusion

Apple Inc. (AAPL) has established itself as an iconic brand that has revolutionized technology and shaped the way we live, work, and communicate. From its humble beginnings in a garage to its status as a global giant, Apple’s journey has been nothing short of extraordinary. Its stock’s remarkable growth trajectory reflects not only its innovative products but also its savvy financial strategies.

Investing in Apple Inc. stock can offer investors exposure to a company that continues to redefine industries and adapt to changing market dynamics. However, as with any investment, thorough research, a long-term perspective, and a clear understanding of the company’s strengths and challenges are essential.

As Apple Inc. continues to push the boundaries of innovation and expand its reach, its stock remains a symbol of the intersection between cutting-edge technology and investment potential, making it a compelling choice for investors seeking growth and stability in an ever-evolving market.

Frequently Asked Questions (FAQs)

How has Apple Inc. evolved from its beginnings in a garage to become a global tech powerhouse with a significant impact on the stock market?

The journey of Apple Inc. from its inception in a garage in Cupertino, California, to its current status as a global tech giant has been marked by groundbreaking innovations and transformative products. Apple’s ability to create iconic devices like the iPhone and iPad, along with a commitment to pushing technological boundaries, has propelled its growth and stock market success.

What factors have contributed to the impressive growth of Apple Inc. (AAPL) stock over the years?

Apple’s stock growth can be attributed to several key factors. The company’s consistent track record of innovation and the introduction of game-changing products like the iPod, iPhone, and iPad have driven revenue and captured consumer interest. Additionally, Apple’s strategic approach to returning value to shareholders through dividends and share buybacks has enhanced investor confidence and contributed to the stock’s appreciation.

How has Apple’s diversification into services impacted its stock’s performance and overall business strategy?

Apple’s expansion into services, such as Apple Music, Apple TV+, and Apple Pay, has provided the company with a more diverse revenue stream beyond hardware sales. This diversification taps into its extensive user base and ecosystem, potentially offering a steady and recurring source of income. The move towards services reflects a strategic shift in Apple’s business model and has the potential to influence its stock’s long-term performance.

What challenges does Apple Inc. face in the highly competitive tech industry, and how might these impact its stock’s future performance?

The tech industry’s rapid evolution presents challenges for Apple, including intense competition, changing consumer preferences, and geopolitical factors that can affect supply chains. Staying ahead of industry trends and maintaining a position as a technological leader is crucial to Apple’s success. Investors should consider how the company addresses these challenges and adapts to maintain its competitive edge when assessing its stock’s future performance.

What should investors consider when evaluating the investment potential of Apple Inc. (AAPL) stock?

When assessing Apple’s inc. investment potential, investors should consider its financial stability, valuation relative to historical metrics and peers, and the company’s ability to innovate and anticipate market trends. Thorough research, a long-term perspective, and an understanding of Apple’s strengths and challenges are essential. Investing in Apple stock offers exposure to a company that has consistently reshaped industries, but a comprehensive analysis of these factors is crucial before making investment decisions.